Monday, September 30, 2019

Steph explains why replacing Andre, Livingston will be hard - NBCSports.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2o6YG3Z

Draymond upset young teammates don't know of Janet Jackson - NBCSports.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2ngCd4B

2020 Dems' top trillion-dollar plans - Fox Business

from RSSMix.com Mix ID 8318969 https://ift.tt/2n48dsJ

Business Casual Episode 2 Transcript: You're the Product - Morning Brew

from RSSMix.com Mix ID 8318969 https://ift.tt/2ndkYRy

Jason Candle Weighs in on Players Making Money Off Their Own Likeness - Hustle Belt

from RSSMix.com Mix ID 8318969 https://ift.tt/2oGVLPP

Andre Rieu at 70: "I'll still be jumping about on stage when I'm 120!" - The Sunday Post

from RSSMix.com Mix ID 8318969 https://ift.tt/2o5vBpW

With value investing making a comeback, this new ETF is worth considering - The Globe and Mail

from RSSMix.com Mix ID 8318969 https://ift.tt/2n7h5hi

Apple Makes Only 1 Product in America. Here's Why It's Really Good News That It Just Got a Major Tariff Exemption - Inc.

from RSSMix.com Mix ID 8318969 https://ift.tt/2nSSWem

How to quit stalling and write your will - Fox Business

from RSSMix.com Mix ID 8318969 https://ift.tt/2mrZeRB

28 Emotional Intelligence Quotes That Can Help Make Emotions Work for You, Instead of Against You - Inc.

from RSSMix.com Mix ID 8318969 https://ift.tt/2mXHaPO

Short-selling: can hedge funds make a fortune from no-deal Brexit? - The Guardian

from RSSMix.com Mix ID 8318969 https://ift.tt/2nZ60i3

6 money-saving habits to adopt now! - SowetanLIVE

from RSSMix.com Mix ID 8318969 https://ift.tt/2oJkbZ3

Marijuana Stocks: How to Profit Twice - Investorplace.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2n0hH8l

5 Signs Your Credit Card Fee Isn't Worth Paying - The Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2neFuBg

After divorce, I'm making sure the next guy has money. Is that wrong? - The Oakland Press

from RSSMix.com Mix ID 8318969 https://ift.tt/2nXtxQK

Mark Cuban believes it's 'patriotic' to pay taxes. Here's why - Fox Business

from RSSMix.com Mix ID 8318969 https://ift.tt/2mt5eK4

Police discover £10m cannabis farm on Merseyside - BBC News

from RSSMix.com Mix ID 8318969 https://ift.tt/2n2kwG0

California to let college athletes sign endorsement deals, defying NCAA - CBS19.tv KYTX

from RSSMix.com Mix ID 8318969 https://ift.tt/2mtCtNi

5 Financial Tips to Guide You From College to The Real World - SavingAdvice.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2ngZYtb

How to retire as a midlife entrepreneur, like this former C-suite exec - Fox Business

from RSSMix.com Mix ID 8318969 https://ift.tt/2oD2DOm

Sunday, September 29, 2019

The 10 Most Expensive Horror Movies Ever Made (& How Much They Made) - TheRichest

from RSSMix.com Mix ID 8318969 https://ift.tt/2ojJ1yr

It's National Coffee Day. Use these hacks to save money at Starbucks. - NBC News

from RSSMix.com Mix ID 8318969 https://ift.tt/2mHqkVd

Why Facebook and Amazon have joined the race to bring computing to your face - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2nBCT4k

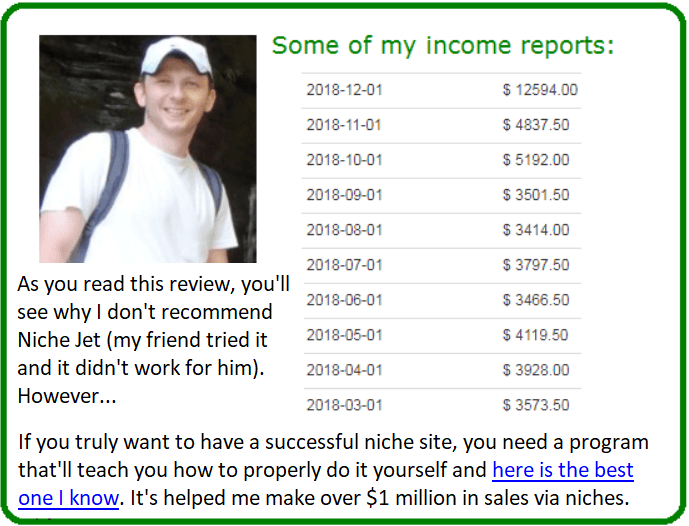

Niche Jet Review: Does it Really Work?

I recently read a review from a friend of mine about Niche Jet and how he tried it. Though he wasn’t thrilled about the results he got, when I read that the program was created by none other than Jonathan Leger, I immediately wanted to see what was up, being a former fan of his. This post will explain if Jon’s program really works and if its worth your time.

I recently read a review from a friend of mine about Niche Jet and how he tried it. Though he wasn’t thrilled about the results he got, when I read that the program was created by none other than Jonathan Leger, I immediately wanted to see what was up, being a former fan of his. This post will explain if Jon’s program really works and if its worth your time.

I am also adding an update to this review, because there has been a slight improvement to the service provided by NicheJet, so in addition to the regular review, I will also mention those updates below.

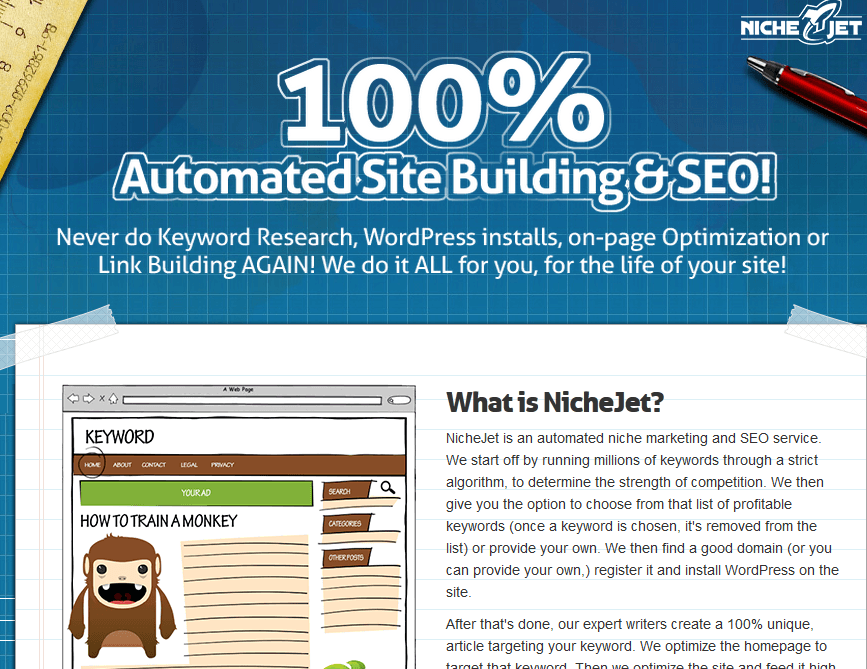

What is Niche Jet?

It is basically a done for you website which includes “all” of the tools needed to build a “successful niche website”. Tools such as:

- Keyword research.

- Niche selection.

- Writing up quality content.

- Backlinks (this is one I believe is BAD for SEO).

- Article writing.

- And more…

Through Niche Jet all of this is done for you.

The idea is that for complete beginners or those too busy to build niche websites, this service does everything for you on autopilot. You just pay the $127 price (for 1 website) and they handle it all for you. Then once they are done, you take the reins and retake control.

Essentially all you have to do is:

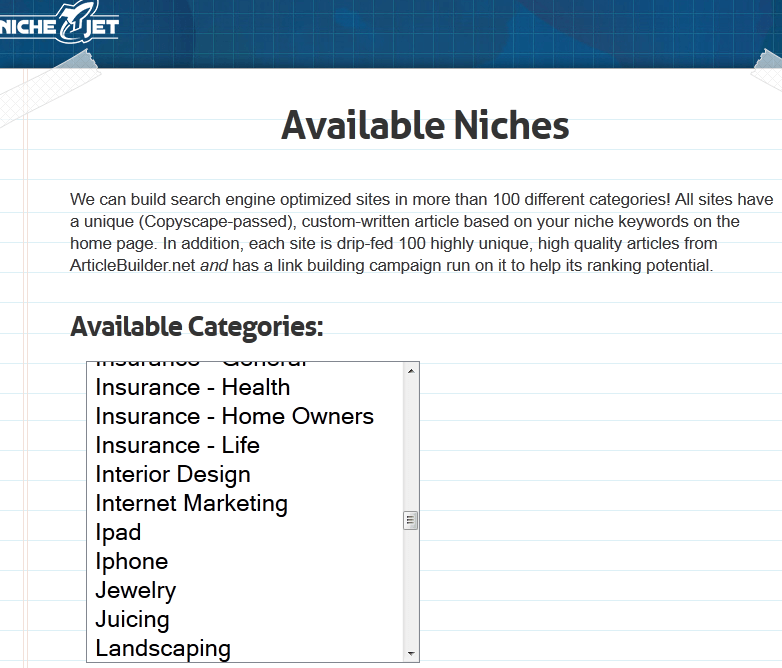

Pick a niche you want to rank in. On Jon’s site, there is a list of “available” niches to rank in. Essentially this is nonsense since  you can rank in any, provided you utilize the proper SEO tactics.

you can rank in any, provided you utilize the proper SEO tactics.

You get to select from a list of 1,000’s of keywords which you would like your future website rank for. Supposedly all of the keywords chosen receive over 200 visitors a month and have little competition which paves the way to high rankings.

I’ve heard from one person that this was false and some keywords which Jon brags about ranking high quickly actually receive less than 50 searches a month, including one that was less than 10.

Some of them don’t always make sense so it will be difficult to sell to a customer who comes to your website through one of these keywords. While it isn’t a bad idea to rank for low competition/low traffic keywords, the argument here was that he was told the keywords were over 200 searches a month. Fair point.

On a side note, the real key to keyword research is to chase low competition keywords and rank under them for starters. When you do, eventually you will start to rank for more competitive/high traffic keywords, but this takes time because the authority of your website needs time to increase in Google’s eyes. But enough about that…

Jon’s team can make a website for you OR you can choose your own domain. Usually I believe they’ll choose an EMD (exact match domain) which basically means the domain name of your website will be one of the keywords you’re chasing.

This is a method that still holds some value, but nowhere near as much as before. Now the content is what REALLY ranks high and that happens regardless of your domain name. I would suggest picking your own domain name if you want to try this service.

And that’s pretty much it. After you’ve done this part, Jonathan’s team handles the rest and here’s how that works:

What Jon’s Niche Jet Does…

A team of writers creates up to 100 different articles which on their main site they say is 75% unique, which is code word for article spinners, at least in my mind. I don’t like that, but I’ll give him the benefit of the doubt.

These articles will then link back to your website, providing a backlink, something which I too am against for these reasons.

They also write up good content on your website and help built it out. The friend I mentioned in the beginning of this post (his name is Nathaniell) said the articles written were high quality and anywhere from 400-1,000 words. This is good (if they aren’t spun).

You also get updates from Jon’s team on your website including if your page/s rank and when. When it comes to support, Jon Ledger has a great reputation and in Niche Jet this is definitely shown.

How long does it take to see results? In my friend’s case, there were no results and the time span of this was 2 months. I’ve heard from a few others that they have seen results, traffic wise and it’s working for them. Certainly if you check out all of the reviews, they are mixed. If you are someone who has used this service, please let me know your experiences/thoughts on it.

So what’s my rating on it? Well I’ll get to that in a minute. But first, the positives/negatives:

Pros:

- Great support.

- Johnathan Leger has a good reputation for making quality products/services FOR internet marketers.

- Niche Jet does follow some proven methods of successful SEO: Quality content writing.

- The official Niche Jet website is VERY upfront and honest about what services they provide. I like this a lot.

Cons:

- Uses backlinks. Depending on who you hear this from, some say they are good. Others say it’s bad. I’m on the latter side.

- Potentially uses article spinners. Another thing I do NOT like. This kind of stuff is very risky to use.

- Results are never guaranteed. This is obvious, but it needs to be mentioned.

- It’s preferable to have total control of your website and not let anyone run it for you.

- Mixed reviews.

Final Rating: Niche Jet

![]()

4 Stars out of 10: Not bad. It can definitely work, but it’s very risky because of some of it’s methods and there are NO guarantees. See #1 recommendation.

Final thoughts: Should you try Niche Jet?

Originally I mentioned that I decided to do a review of this because the product was created by Jon Leger. The first time I actually started online marketing was through one of his products: $7 Secrets.

It wasn’t successful for me, but at the time if you were a knowledgeable internet marketer, you could make that product work for you. Jon has been able to maintain a huge following since due to him constantly providing good products and ways for online marketers to succeed.

However, in today’s world many of his products are outdated. In Niche Jet’s case, the fact that they use backlinks & potentially article spinners is something I am totally against. These are black hat methods to marketing which will eventually crumble, meaning if you set up a website through Niche Jet, you are risking it being on a shaky foundation.

When a Google update occurs, a Niche Jet website will have a high probability of being Google slapped, which puts the entire business at risk. Thus I put this product in the avoid section. I’ve personally used backlinks before from another service called Bring The Fresh. It started off well, but ended badly for me. Learn from me mistakes!

Besides this, my biggest pet peeve with this service is that it takes away control from YOU, at least at first. The problem with this is that whenever you make a niche website, it is YOUR business. And having someone else handle it, even if at first is something I do not like doing.

- The incentive to succeed just isn’t there. Me writing for my site is very different than someone else doing it for me.

- The content written isn’t yours. You want your site to reflect YOUR persona.

- It’s disingenuous in my opinion. Anything that involves taking away your control of your website is something I’m against.

Even though you DO retake control after awhile, the fact that they use methods I’m against in addition to this is why I am not for using this service. Certainly there are places that charge you $1,000’s for this kind of service (Bring the Fresh is one of them).

I DO however like that Jon is upfront about his programs. Niche jet is NOT a scam. But it is founded on outdated principals which may very well ruin your site in the long run. And that outweighs it’s pros, no matter how many there are.

Any alternatives?

I would imagine that many people who are considering using Niche Jet fall into 2 categories:

1. Beginners to SEO who want experts to handle it for them.

2. Those who have money to spend on Niche sites who just want to sit back or focus on other priorities which Niche Jet does the hard work for you.

Regardless of which one you fall into, I never recommend this done for you approach to building niche sites because the risks outweigh the benefits. Experience has taught me this. My best advice is to utilize proper guidance and be in control of your own website.

My #1 recommendation shows you gives you that proper guidance and provides the most updated and slap proof (white hat) methods to succeeding in SEO. It is up to you however to utilize these methods in your own niche sites.

Does it mean you’ll succeed? No. there are no guarantees, but what you learn does work if utilized correctly. It does take time though. It can be weeks and even months for most people, but at least you know you’re on the right track and you have all the power to succeed. Plus it’s a hell of a lot cheaper to try this alternative than to pay $100’s to a service who cannot guarantee success. In fact, I just want to point out there is no such thing as a guarantee in internet marketing so any company which claims that is lying.

If you have used Niche Jet or have any questions/comments on it, feel free to leave your comment below! I’d love to hear your thoughts on this service and if you were able to get results.

Update: Niche Jet’s second option…

A recent comment on this review mentioned that this service has gone through some changes and even offers a discount. You can check out the services offered by Niche Jet here, but overall, you can now get an upgraded service to get you a higher quality niche site.

Based on the bullet points I saw for this service, which is at $397, I don’t think it’s worth the cost, even with a 25% discount. Some of the reasons why are because what they say they provide you with is not what I would consider to be worthy of an authority blog.

If you are still looking for DIY services, I’d recommend something like Human Proof Designs. But ideally, you should start fresh and build your own authority niche site, and in my opinion, here is the best program that’ll help with that.

from RSSMix.com Mix ID 8318969 https://ift.tt/2m9IZsp

‘I gave away our stuff’: the minimalists doing more with less - The Guardian

from RSSMix.com Mix ID 8318969 https://ift.tt/2mMqhXV

The truth about CBD: the hemp wellness market is worth £300 million –should you be buying into it? - Telegraph.co.uk

from RSSMix.com Mix ID 8318969 https://ift.tt/2mPa7gq

Peddlers Outside Empower Field At Mile High Call New Rules ‘Draconian’ - CBS Denver

from RSSMix.com Mix ID 8318969 https://ift.tt/2mSq5GE

SpaceX Unveils Silvery Vision to Mars: ‘It’s Basically an I.C.B.M. That Lands’ - The New York Times

from RSSMix.com Mix ID 8318969 https://ift.tt/2m5TSvl

Less Than a Third of Americans Are Confident About Their Financial Future -- Here's How to Save More - The Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2m2ZaYi

Box Office: ‘Abominable’ Tops With $21 Million Weekend As ‘Judy’ Kicks Off Oscar Season In Style - Forbes

from RSSMix.com Mix ID 8318969 https://ift.tt/2nFB8mH

Opinion: Vegans Couldn't Convince People To Give Up On Meat, But Maybe Capitalism Will - BuzzFeed News

from RSSMix.com Mix ID 8318969 https://ift.tt/2omjW67

Trading, Investing, And The Psychology Of Resilience - Forbes

from RSSMix.com Mix ID 8318969 https://ift.tt/2mCzW3v

At 70, Communist China is older than the Soviet Union, while rivaling U.S. economic power - Los Angeles Times

from RSSMix.com Mix ID 8318969 https://ift.tt/2mQT6Th

Bass guitarist Bruce Foxton sticks to Jam hits - as it's safer than playing the stock market - This is Money

from RSSMix.com Mix ID 8318969 https://ift.tt/2mNAoM9

Ex-MI6 chief says British spies are angry with John Le Carré for making them look heartless and immoral - The Telegraph

from RSSMix.com Mix ID 8318969 https://ift.tt/2mU1jG7

NAB, BPAY quietly back payday loan killing API - iTnews

from RSSMix.com Mix ID 8318969 https://ift.tt/2nFMzLa

Racist tweets, backlash drama surround viral 'beer money' fundraiser - ABC News

from RSSMix.com Mix ID 8318969 https://ift.tt/2ohoj2b

10 tips and tricks for saving money at Whole Foods - CNET

from RSSMix.com Mix ID 8318969 https://ift.tt/2m6rSHN

Why Facebook and Amazon have joined the race to bring computing to your face - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2nBCT4k

‘You ought to get a second chance’: Several Alabama inmates resentenced - AL.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2mNEMuI

Mitch Albom: The risky lure of Rashida Tlaib's angry T-shirt - Detroit Free Press

from RSSMix.com Mix ID 8318969 https://ift.tt/2nyoF4m

Why haven't Jaylon Smith and Leighton Vander Esch lived up to their performances from last season? - The Dallas Morning News

from RSSMix.com Mix ID 8318969 https://ift.tt/2ny7AXY

Digital Transformation Doesn't Just Increase Revenue, It Can Impact Employee Productivity Too - Forbes

from RSSMix.com Mix ID 8318969 https://ift.tt/2nCwbeg

Winning the breadwinner vs. homemaker battle | | thetandd.com - The Times and Democrat

from RSSMix.com Mix ID 8318969 https://ift.tt/2mKSvCp

East Moline Paletera Project was a success - KWQC-TV6

from RSSMix.com Mix ID 8318969 https://ift.tt/2mK5Nz9

In U.S.-Ukraine dealings, Russia is never far away - Greenwich Time

from RSSMix.com Mix ID 8318969 https://ift.tt/2m4UrFG

Saturday, September 28, 2019

Money-making hack: Renting clothes online - BBC News

from RSSMix.com Mix ID 8318969 https://ift.tt/2nwBnAu

Special grand jury proposes new laws to prosecute illegal dumping on LI - Newsday

from RSSMix.com Mix ID 8318969 https://ift.tt/2mJNrOD

The tale of two towns that shows why our bank branches MUST be saved - This is Money

from RSSMix.com Mix ID 8318969 https://ift.tt/2oile29

Why haven't Jaylon Smith and Leighton Vander Esch lived up to their performances from last season? - The Dallas Morning News

from RSSMix.com Mix ID 8318969 https://ift.tt/2ny7AXY

Here's What We Know About Woody Harrelson's Net Worth - menshealth.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2nu22xM

How you can earn money by selling online while travelling - Breaking Travel News

from RSSMix.com Mix ID 8318969 https://ift.tt/2odYMHh

Five Questions: A Look Back - Kennebec Journal & Morning Sentinel

from RSSMix.com Mix ID 8318969 https://ift.tt/2mI5hld

3 Financial Habits That Can Help You Retire Rich - The Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2nwZH55

Everything Jim Cramer said about the stock market on 'Mad Money,' including investing next week, foreign drug stocks, Conagra earnings and GoodRx CEO - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2nfRylz

Constable: Family brews up 7 generations of Naperville entrepreneurs - Chicago Daily Herald

from RSSMix.com Mix ID 8318969 https://ift.tt/2m29MXy

Antonio Brown working on grievance against Raiders to recoup some money lost by release, per report - CBS Sports

from RSSMix.com Mix ID 8318969 https://ift.tt/2o9NALO

As Amazon floods the market with Alexa devices, the business model is getting fresh scrutiny - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2lVO73e

‘I just don’t feel there’s anyone good’: Canada’s undecided voters know what they want, but not who - Global News

from RSSMix.com Mix ID 8318969 https://ift.tt/2lXwdgA

WATCH: Kevin Lerena's children motivate him to keep winning | Saturday Star - Independent Online

from RSSMix.com Mix ID 8318969 https://ift.tt/2nqWFzq

Silicon Valley’s final frontier for mobile payments — ‘the neoliberal takeover of the human body’ - MarketWatch

from RSSMix.com Mix ID 8318969 https://ift.tt/2POSbAl

The Future of Biotech: How to Invest in Tomorrow’s Winners - Barron's

from RSSMix.com Mix ID 8318969 https://ift.tt/2mlc8RD

Peloton falls 15% from IPO price – four experts on what this means for IPO market - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2nVQnrR

Is Wynn Resorts Restoring Free Parking Because It's Worried About Las Vegas? - The Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2lDK5ME

What would be the worst-case scenario under new ownership? - Royals Review

from RSSMix.com Mix ID 8318969 https://ift.tt/2naa6DV

Should New Grads Take Any Job or Wait for the Right One? - Harvard Business Review

from RSSMix.com Mix ID 8318969 https://ift.tt/2mjWd5L

Uber adds more services to its app in its quest for profit - Northwest Herald

from RSSMix.com Mix ID 8318969 https://ift.tt/2nWPJdw

Everything Jim Cramer said about the stock market on 'Mad Money,' including investing next week, foreign drug stocks, Conagra earnings and GoodRx CEO - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2nfRylz

Research report: Investing in commercial real estate - Inman

from RSSMix.com Mix ID 8318969 https://ift.tt/2muh86n

Peloton falls 15% from IPO price – four experts on what this means for IPO market - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2nVQnrR

How influencers make a living by posting on Instagram - iNews

from RSSMix.com Mix ID 8318969 https://ift.tt/2nT4Sg3

Mark Cuban recalls the moment he told his dad he made $100,000 for the first time - CNBC

from RSSMix.com Mix ID 8318969 https://ift.tt/2mjsPwz

Friday, September 27, 2019

Keith Thurman’s wish for Pacquiao rematch not in the cards - Bad Left Hook

from RSSMix.com Mix ID 8318969 https://ift.tt/2nqGUID

Just How Bad Will Harley-Davidson's Third Quarter Be? - Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2muDGUm

Honey, doughnuts and beer: How a 10-year-old beekeeper from Wauwatosa is learning business principles - Milwaukee Journal Sentinel

from RSSMix.com Mix ID 8318969 https://ift.tt/2noJgrO

'Ludicrous' gives Elon Musk his due while detailing Tesla's foibles - Los Angeles Times

from RSSMix.com Mix ID 8318969 https://ift.tt/2nhzur2

Most-Common Money Mistakes: Getting a 15-Year Mortgage - Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2ncS4ke

Sound Off for Saturday, Sept. 28 | Opinion | delcotimes.com - The Delaware County Daily Times

from RSSMix.com Mix ID 8318969 https://ift.tt/2nWvWLf

This hair tie could prevent drink spiking at bars, parties - Fox Business

from RSSMix.com Mix ID 8318969 https://ift.tt/2mvxLOV

Whistleblower alleges White House coverup: Live updates - CNN

from RSSMix.com Mix ID 8318969 https://ift.tt/2mjUaPh

GUEST LETTER: Salaried Athletics - Arizona Daily Wildcat

from RSSMix.com Mix ID 8318969 https://ift.tt/2nkwqdY

Ethical investments: what to choose for a greener future - The Times

from RSSMix.com Mix ID 8318969 https://ift.tt/2nlp4qy

8 Common Challenges to Flipping a House - Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2ninc1X

Tucson sounds: DIY double feature with Banana Pancakes & Mahmood Gladney | Weekend music - TucsonSentinel.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2mvJ9KC

Hunker is a media company. It also makes furniture. Welcome to 2019 - Business of Home

from RSSMix.com Mix ID 8318969 https://ift.tt/2nWLeQt

Should New Grads Take Any Job or Wait for the Right One? - Harvard Business Review

from RSSMix.com Mix ID 8318969 https://ift.tt/2mjWd5L

Which university you study at makes you richer than what you study - The National

from RSSMix.com Mix ID 8318969 https://ift.tt/2nL6jx2

Cement truck crashes while making turn on Division; diverts traffic - KWQC-TV6

from RSSMix.com Mix ID 8318969 https://ift.tt/2nL6gkQ

Computer science students at Purdue work to make technology more transparent - FOX 59 Indianapolis

from RSSMix.com Mix ID 8318969 https://ift.tt/2m6E0Zi

Purdue students create app that scans user agreements of tech companies - CBS 4 Indianapolis

from RSSMix.com Mix ID 8318969 https://ift.tt/2nDyw8O

Thursday, September 26, 2019

Opinion | Peterborough letter: Automation will change our world ... are we ready? - ThePeterboroughExaminer.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2n3gfBK

The best 7 ideas to make Easy Money. - ThyBlackMan

from RSSMix.com Mix ID 8318969 https://ift.tt/2lzjjoQ

Meet the world's highest-earning child influencers of 2019 - Daily Mail

from RSSMix.com Mix ID 8318969 https://ift.tt/2n8cLh4

UAW strikers prepare for the worst, hope for the best: 'There will be some hardships' - The Detroit News

from RSSMix.com Mix ID 8318969 https://ift.tt/2m0DKva

Silicon Valley And 'Skepticism For Disruption' Inspired This Futuristic Taxi Game - Kotaku

from RSSMix.com Mix ID 8318969 https://ift.tt/2lqimyT

Uber adds more services to its app in its quest for profit - Washington Post

from RSSMix.com Mix ID 8318969 https://ift.tt/2nBlQPY

Computer science students at Purdue work to make technology more transparent - FOX 59 Indianapolis

from RSSMix.com Mix ID 8318969 https://ift.tt/2m6E0Zi

Wall Street Skeptics Poke at Start-Up Bubble - The New York Times

from RSSMix.com Mix ID 8318969 https://ift.tt/2lo2bCa

Rick Scott Compares Mitt Romney to Nancy Pelosi: He 'Doesn't Speak' for GOP Senators - Breitbart

from RSSMix.com Mix ID 8318969 https://ift.tt/2lUf5s5

3 Low-Risk, Safe Options Trading Strategies – Money Morning - Money Morning

from RSSMix.com Mix ID 8318969 https://ift.tt/2n609af

AT&T COO Shares More Details on His Strategy for HBO Max - Cord Cutters News, LLC

from RSSMix.com Mix ID 8318969 https://ift.tt/2lgaEau

You Can’t Actually Start a Business for Free

If you have dreams of entrepreneurship, don’t quit your day job just yet. As lovely as it would be, you can’t start a business for...

The post You Can’t Actually Start a Business for Free appeared first on SavingAdvice.com Blog.

from RSSMix.com Mix ID 8318969 https://ift.tt/2nBBdYx

The best credit cards for building credit in 2019

Advertiser Disclosure: I Will Teach You To Be Rich has partnered with CardRatings for our coverage of credit card products. I Will Teach You To Be Rich and CardRatings may receive a commission from card issuers.

Editorial Disclosure: Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Sometimes we get dealt a bad hand and end up with a bad credit rating. Or maybe we’re trying to build up our credit rating for the first time.

Either way, we can find ourselves in a trap.

Credit card issuers want good credit scores in order to approve us for a new credit card. But we need a credit card to improve our credit.

I’ve got good news.

You have options. And these aren’t scammy deals that will take advantage of you. Even with bad credit, it’s still possible to get a credit card and rebuild your credit.

The Top 4 Cards for Building Credit

- Capital One QuicksilverOne Cash Rewards (Best Rewards Card While Building Credit)

- Capital One Spark Classic for Business (Best for Rebuilding Business Credit)

- Capital One Secured (Best Secured Card for Bad Credit)

- Journey Student Rewards from Capital One (Best for Students)

Jump ahead to

- The Best Credit Cards for Average Credit

- The Best Credit Cards for Bad Credit

- The Best Credit Cards for Students

- How to Choose The Right Card for Building Credit

- Credit Cards for Building Credit Reviews

The Best Credit Cards for Average Credit

- Capital One Platinum Credit Card

- Capital One QuicksilverOne Cash Rewards

- Capital One Spark Classic (Business)

If you have a decent credit history but can’t quite get the premium credit cards yet, start with a rewards card for folks with average credit.

Compared to the premium rewards cards, these cards offer fewer rewards at higher APRs. You’ll want to get in the habit of paying off your cards every month. So the APR shouldn’t matter.

So the only real difference between these cards and premium cards is that the rewards aren’t quite as good.

But it’s still something. And these cards help you build up your credit. You’ll build credit while earning some rewards along the way. That’s a great deal.

If you have a high enough credit score to get one of these cards, start here.

The Best Credit Cards for Bad Credit

Let’s say something happened and you now have bad credit. Every time you apply for a new credit card, you get denied.

Now what?

Even with bad credit, you still have options.

I recommend considering one of the secured credit cards. These cards are still credit cards so you will build up a credit history with them. If you always pay on time (which you should be doing), you’ll slowly improve your credit score and unlock better credit cards.

The difference if that you have to put a deposit down when you open the card. Depending on your credit score, the deposit usually ranges from $50 to $200. The bank holds onto this deposit and will keep it if you skip too many payments.

The deposit allows the bank to offer credit cards to a larger range of folks than a standard credit card.

Yes, it is inconvenient to save up enough for the deposit but it’s a better option than not having a credit card at all. Credit cards are the easiest ways to build your credit score which will get you better credit cards, more credit, and better interest rates on mortgages and loans. It’s definitely worth the effort.

The Best Credit Cards for Students

- Discover it Student Cash Back

- Discover it Student Chrome

- Journey Student Rewards from Capital One

- Deserve Edu MasterCard for Students

I was a student when I got my first credit card.

A bunch of bills hit me all at once, including some hefty maintenance on my pickup that I hadn’t planned for. I went from having a couple of hundred dollars in my checking account to being about $500 short of what I needed to pay all my bills.

So I went around town and applied for a credit card at every bank. They all turned me down.

Then I went to the credit union on campus that offered student credit cards. Their approvals department initially denied my application until the banker advocated for me. He got me approved at half their usual credit line for students.

After paying my bills with that credit card, I paid the card off on time and started building my credit score. A decade later, I have good enough credit to get just about any credit card I want.

When you’re a student, many banks will turn you away outright. That’s what happened to me. Going to a bank and choosing a student card can get you out of this trap. Student credit cards are designed for folks without any credit history and low to no income. As long as you’re a student, the requirements get much more flexible.

That’s how I got started.

Once you have your first card, pay if off every month to build your credit. Then in a few years, apply for a card for average credit scores to get your first rewards card. The point is not to be picky as a student, get any card that doesn’t have annual fees and use it to build your credit. Worry about the rewards and perks once you’ve built up your credit a bit.

How to Choose The Right Card for Building Credit

What’s the best way to right the best card for building your credit rating? Follow these steps.

1. Avoid Annual Fees

Lots of the premium credit cards have annual fees. They give rewards and perks which easily exceed the value of the fee.

But when you’re building credit, you’re not going to get the best rewards or perks. Your primary goal is to build up your credit rating so you can get access to the better credit cards later. Fees are only going to slow you down at this stage.

When I was building my credit up, I avoided fees entirely. That kept more money in my pocket and kept things really simple until I had a good enough credit score to get the premium credit cards. I recommend you do the same.

We’ve included reviews of some cards that have annual fees. Sometimes they offer rewards and it’s worth it. In other cases, they might be the last option available. Avoid fees if you can. And if you can’t, switch to a no-annual fee card as soon as you can once you’ve built up your credit score.

2. If You’re a Student, Get a Student Credit Card

As a student, you’re stuck in a catch-22.

You need a credit score in order to get a credit card. But you need a credit card in order to build a credit history and get a credit card. Breaking this cycle can get tricky.

These days, there are great credit card options for students that help kick-start everything.

Most of them don’t have annual fees, some have a few rewards and parks, and they’re specifically designed for students so you’re odds of being approved are much higher.

If you’re a student, get a student credit card. That will put you on the path to building credit and you’ll be able to get a much better card later assuming you always pay your monthly bill on time.

3. Start with One Card for Bad Credit

Maybe you’re building from scratch. Maybe, you’ve hit a rough patch. Whatever it is, we’ve all gone through tough times.

If you know that your credit score isn’t great or you’re building your credit from scratch for the first time, get a card for bad credit.

Why start at the bottom?

Every time you apply for a card, your credit score will take a hit.

It’s true, part of your score is dependent on how many credit requests that you’ve had recently. If you apply to a bunch of cards all at once, your score will go down a bit.

I personally hate this. Right when you really need a credit card, the process of applying for credit cards makes your credit worse.

The credit score hits are minor but they do add up.

When we’re going through a rough patch, a single card can mean the difference between paying our bills or not. I’ve been there, my first card got me through a cash crunch.

The last thing we want to do when we’re in this situation is try to apply to cards out of our reach, ding our credit score, and make it even harder for ourselves to get one credit card.

I recommend getting a credit card that you’re confident that you’ll be approved for. That way, you’ll have some breathing room to make your bills and you can start building your credit. Even if you get declined on the rest of your credit card applications, you’ll have one card to work with.

Unless you’re positive that you have at least average credit, start with the cards for lower credit scores.

And I’d absolutely go straight to these cards if I’ve recently been declined 1-2 times already and really needed a credit card. As long as you get a card without an annual fee, there’s no downside to keeping a credit card open. It actually helps your credit score a bit by increasing your total available credit limit.

4. Get One Card at The Average Tier When You Can

Once you have one credit card that you’ve been using awhile and have built up your credit, try applying for one of the credit cards for folks with average credit. These aren’t the premium cards but you will get started with some rewards.

As a general rule, consider applying for one of these cards once you’re credit score is 600 or above. There’s no guarantee you’ll be approved but this is the range where it becomes a possibility. And the odds are in your favor once you get close to a credit score of 700 and above. Remember to only apply once in case your score isn’t high enough. If you’re declined, continue building your credit for another year or two and try again.

I’d avoid multiple cards at this tier so only apply for one at a time. There’s no reason to have more than one. Later on, you can consider having multiple premium cards to maximize rewards and perks. But at this stage, you want one decent card that will give you some rewards while you keep building credit. Continue to avoid fees and keep things really simple at this stage.

Credit Cards for Building Credit Reviews

Here are our reviews on all the best credit cards for building credit:

Capital One Platinum Credit Card

The Capital One Platinum card offers a no-frills basic credit card. There’s no rewards, no annual fee, and no foreign transaction fees. It’s a basic credit card without any fees dragging you down.

For building credit, it’s a fantastic option. Especially without annual or foreign transaction fees. When a card doesn’t have rewards, it’s really important to avoid fees since every dollar comes straight out of your pocket.

Yes, there aren’t any rewards but it’s a real bonafide credit card without any downsides.

Even better, you’ll get a higher credit line after making your first 5 month payments on time. Usually, you have to call credit card companies and ask them to increase your credit and justify it with a higher income. Having a built-in credit increase will help you increase your credit score even faster.

When I was starting out, I would have been thrilled to get this card.

*Terms apply – Learn how to apply online.

Capital One QuicksilverOne Cash Rewards

If you can get this card, get it.

The rewards are as good as they get outside of the top tier cards that require great credit scores.

You’ll get 1.5% cash back on every purchase. For context, the best cash back cards give 2%. So this card is close to the top.

There aren’t any bonus or rotating categories to worry about either. You’ll get a straight 1.5% cash back on every purchase. I love simple cash back cards like this because I don’t have to manage anything. I spend, I get cash back rewards, that’s it.

Your credit limit will also go up after you make your first 5 month payments on time. Part of your credit score is determined by your “credit utilization” which is a fancy way of saying what percentage of your total credit limit you use at any given moment. The lower the percentage, the better. So having a high total credit limit means you’ll use a small percentage and improve your credit score faster.

It does have a $39 annual fee. As long as you spend $2600 on your card each year, you’ll come out ahead and earn more in rewards than you spend on the annual fee. That comes to about $220/month in credit card spending.

One other perk: Capital One has an upgraded version of this card called the Capital One Quicksilver. It’s the same card without an annual fee and has a lower APR. The catch is that you’ll need a higher credit rating in order to get it. Once you’ve used the QuickSilverOne for awhile and built up your credit score, you should have an easier time upgrading to the better version since the card is at the same bank you already have a history with. Once your credit is high enough, this simple upgrade will give you one of the best cash back cards out there.

*Terms apply – Learn how to apply online.

Capital One Spark Classic (Business)

Business credit ratings work a bit differently than personal credit ratings. Each rating agency uses their own method, businesses have their own credit ratings, and your personal credit rating can be used as a substitute for your businesses’ credit rating.

Even if you have a great credit rating personally, you might have to start from scratch with your business. And a poor personal credit rating can negatively impact the rating of your business.

If you find yourself needing to improve the credit rating of your business, try to get the Capital One Spark Classic.

It’s a simple and solid rewards card for businesses with average credit ratings.

You’ll earn a straight 1% cash back on every purchase. Yes, other cash back cards have higher percentages but you’ll have a much easier time getting approved for this card. No hoops to jump through either. No rotating or bonus rewards categories to remember.

There isn’t an annual fee to worry about and no foreign transaction fees.

It’s a super simple card with a decent cash back amount for businesses that need to build their credit some more before going after the premium cards.

*Terms apply – Learn how to apply online

Capital One Secured Mastercard

The Capital One Secured Mastercard is my favorite secured card.

This is still a credit card so it has the same impact on building your credit rating as any normal credit card.

The difference is that you’ll put down a deposit of $49-200. The deposit stays with the bank and can be taken if you go delinquent. As long as you stay on top of your credit card payments, you’ll get the deposit back if you ever close the account.

Credit lines start at $200 and go up after your first 5 monthly payments that are made on time. If you need more credit each month, you can pay some of it off with an extra payment so you can keep using your card.

And there’s no annual fee or foreign transactions fees.

There’s no gotchas or tricks. You put a deposit down, you get a credit card, then you start rebuilding your credit. Nice and simple.

If you’re rebuilding your credit and don’t have access to other cards, I highly recommend this one. It’s a fantastic card to start with.

*Terms apply – Learn how to apply online.

Discover it Secured

To get rewards with a secured card, get the Discover it Secured. Rewards are really rare with secured cards.

You’ll get 2% cash back at gas stations and restaurants up to $1000 in purchases each quarter. You’ll also get 1% cash back on all other purchases.

Those are decent rewards on their own and they’re fantastic for a secured card.

Since it’s a secured card, you’ll need to put down a deposit of at least $200. A $200 deposit gets you a $200 credit line and a $500 deposit gets you a $500 credit line.

Once you’ve used the card responsibility over a long period, you’ll get the option to convert the card into a non-secured card. These reviews happen automatically every month starting at 8 months after getting the card.

There’s no annual fee either.

And all the cash back that you earn the first year will be matched by Discover. So the cash back for your first year is doubled. It’s a nice bonus.

Like all Discover cards, it has the downside of not being accepted everywhere. If it’s your primary card, make sure you have another card with you even if it’s a debit card. It will be turned away by businesses on a regular basis.

*Terms apply – Learn how to apply online.

Indigo Mastercard

The Indigo Mastercard is a normal credit card and there’s no deposit required like the secured credit cards.

If you have poor credit, it can be risky to keep applying to different credit cards, hoping one of them approves you. Every application dings your credit rating a bit. That’s the last thing anyone wants when their score is already low.

The Indigo Mastercard does a quick, 60 second pre-qualification for you that doesn’t impact your credit score. This is super helpful when you’re trying to rebuild your credit. You’ll find out if you can get access to this credit card without having to risk lowering your credit score.

This “pre-qualification” isn’t a guarantee though, it’s an initial prediction on whether you’ll be approved. You’ll only get the real answer once you officially apply and they do a real credit check.

Watch out for the variable annual fee. Depending on your credit score, you’ll get an annual fee between $0 and $99. Since this card doesn’t have any rewards, that annual fee comes straight out of your pocket and there’s no way to earn it back.

You’ll find out what the annual fee is when you complete their pre-qualification process.

If you get an annual fee, you’ll be better off going with a secured card which allows you to get your deposit back. You only have to pay the deposit on a secured card once. With the Indigo Mastercard, you’ll have to pay the annual fee every year.

But if a secured card isn’t an option for you and this is the only credit card that will approve you, it is an option. And paying it off consistently will allow you to build credit. Sooner or later, you’ll be able to switch to a better card. Just keep in mind that you’ll eat the annual fees along the way.

Also watch out for the 1% foreign transaction fee. That will add up while traveling.

*Terms apply – Learn how to apply online.

Credit One Bank Platinum Visa

Not many cards offer cash back rewards card to folks with lower credit scores. Credit One Bank Platinum Visa does.

You’ll get 1% cash back on these categories:

- Gas

- Groceries

- Services such as mobile phone, internet, cable, and satellite TV

That’s pretty amazing.

But be careful with this card. There is a catch.

There’s a variable annual fee of $0 to $99 depending on your credit rating. Normally, this would be fine with a rewards card. But the cash back on this card only applies to gas, groceries, mobile phone, internet, cable, and satellite TV. If you get stuck with the $99 annual fee, you’ll need to spend $9,900 every year on these categories. That’s a lot for gas, groceries, and a few monthly bills.

If you don’t spend enough to earn the cash back to cover the annual fee, you’ll be paying for the privilege to use this card. When you’re building credit, every dollar counts and I’d consider other cards before going this route.

Hopefully, you’ll get an $0 annual fee on this card and it won’t be an issue.

One other perk: Credit One Bank regularly evaluates your account in order to give you a credit line increase as soon as you’re ready. This makes it a lot easier to increase your total credit limit, lower your credit utilization, and increase your credit rating faster.

Lastly, you can pick the due date for your card. This is super helpful when balancing bills. I recommend picking a day right after your second paycheck of the month (assuming you get paid twice per month). Your first paycheck will go to rent while your second paycheck can cover your monthly credit card bill.

*Terms apply – Learn how to apply online.

Discover it Student Cash Back

The Discover it Cash Back is the best of the “rotating cash back cards.” These cards cycle through different purchase categories each quarter. During that quarter, the purchase category earns 5% cash back. One quarter will be gas stations, another will be Amazon.com, etc.

A 5% cash back is super high when the standard is usually 1-2%. In exchange for the higher reward percentage, you’ll have to remember the difference promotional categories as they change. For myself, I avoid these types of cards. It’s just too much hassle to manage for me. But if you want to maximize your rewards, this is the way to do it.

You will also earn 1% cash back on all other purchases which is decent for a student card.

I’m not the biggest fan of first-year promos. They come and go quickly, I don’t like choosing cards based on them. But this card does have a promotion that’s worth mentioning. For the first year, Discover will match the total cash back that you’ve earned with no limit. That’s pretty cool. Again, don’t choose this card just for the first year promotion but it is a nice perk.

The card also has a good grade award. You’ll get $20 in statement credit each year your GPA is 3.0 or higher for up to 5 years. I would have gladly used that money to buy myself an extra burrito and some beer when I was in college.

You won’t have an annual fee with this card.

There aren’t fees for missing your first payment and the APR won’t change for late payments either. But if you’re taking advantage of these perks, you need to work on better credit card habits. Credit cards really slow down your ability to build wealth and a better credit rating if you don’t pay them off every month. So I wouldn’t consider these to be perks.

Remember that this is a Discover card so businesses will refuse to accept it somewhat regularly. Make sure you have another credit or debit card on you just in case.

*Terms apply – Learn how to apply online.

Discover it Student Chrome

If you want to avoid rotating cash back categories and still get some bonus cash back, this is a great option.

You’ll earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter. If you max this out by spending $4000 on these categories per year, you’ll get $80 cash back.

When I was in college, restaurants and gas were definitely some of my biggest spending categories. This card would have been a great fit for me.

Like some of the other Discover Student cards, it does have a great first-year promotion. Discover will match all the cash back that you earn in the first year, that doubles your cash back rewards for one year. That’s a great perk. Just remember, promotions come and go quickly so don’t sign up for this card just for the promotion.

You’ll also get a statement credit of $20 ear year your GPA is 3.0 or higher. This lasts for up to 5 years after you get the card. That’s another $100 of potential rewards.

There’s no annual fee to worry about.

While you won’t get a late fee for your first late payment and the APR won’t increase from late payments, I strongly encourage you not to take advantage of these perks. Paying late is a horrible habit to get into and you’ll lose a tremendous amount of money to interest charges if you carry a balance. Your credit score will also get trashed from late payments, making car loans and mortgages much more difficult later on. It’s better to skip credit cards entirely and just use a debit card if you carry a balance or pay your credit cards late.

There is one major downside to this card: it’s a Discover. On a regular basis, businesses won’t accept the card. Make sure to have another Visa or Mastercard on hand even if it’s just a debit card.

*Terms apply – Learn how to apply online.

Journey Student Rewards from Capital One

If I could go back and choose a card when I started college, I would pick this card. It’s simple, has a solid cash back rate, and no fees to worry about.

It’s everything you could want from your first rewards card.

You’ll earn 1% cash back on every purchase. That gets bumped to 1.25% when you pay on time. You should be taking advantage of this bonus every single month, get in the habit of always paying off your credit card on time. It’s the only way to get any value from your rewards. Otherwise the interest charges will devour any cash back that you earn.

No annual fees to worry about. And no foreign transaction fees either. You can spend without having to worry about either.

It also has the option to pick your monthly payment date, this is helpful when you want to align your credit card payment with when you get paid.

And once you make your first 5 payments on time, you’ll automatically get a higher credit line. This helps you build your credit score faster which comes in handy when you apply for a car loan or a mortgage down the line.

I highly recommend this card for students, get it if you can.

*Terms apply – Learn how to apply online.

Deserve Edu MasterCard for Students

When you sign up for the Deserve Edu MasterCard, you’ll get one year of Amazon Prime for Students for free (a $59 value). To be honest, this perk isn’t that amazing. It’s a nice little bonus but don’t pick the card for this perk alone. One year goes by pretty fast.

It’s still a great card though.

Getting a 1% cash back on all purchases as a student is an amazing deal.

The real benefits from this card come from what’s NOT required:

- No SSN required = perfect for international students studying in the US

- No credit history required = perfect for students that have never had a credit card before

- No deposit required = perfect for students without cash on hand

- No cosigner required = perfect for students that don’t want to involve their families

And no annual or foreign transaction fees either.

For students that need to get their first card and need some flexibility on the application, this card is a fantastic option.

*Terms apply – Learn how to apply online.

Advertiser Disclosure: I Will Teach You To Be Rich has partnered with CardRatings for our coverage of credit card products. I Will Teach You To Be Rich and CardRatings may receive a commission from card issuers.

The best credit cards for building credit in 2019 is a post from: I Will Teach You To Be Rich.

from RSSMix.com Mix ID 8318969 https://ift.tt/2lTcfUd

Uber Adds More Services to Its App in Its Quest for Profit - NBC4 Washington

from RSSMix.com Mix ID 8318969 https://ift.tt/2nE5INL

Check out our exclusive list of the top 10 banks making millions off of cannabis deals - Business Insider

from RSSMix.com Mix ID 8318969 https://ift.tt/2lqve8e

Who Are the Highest-Paid Musicians of 2019? - TheStreet.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2m8VBzY

General Mills CMO says agencies need to win back more of his 'trust, admiration and money' - AdAge.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2m64s5h

Our 5 Most Common Money Mistakes, and How to Avoid Them - Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2mVWV9u

7 surefire ways to fail in your startup - USA TODAY

from RSSMix.com Mix ID 8318969 https://ift.tt/2nby8yh

Making Sense of Antonio Brown's Guaranteed Money in NE - WTMM 104.5 The Team - ESPN Radio

from RSSMix.com Mix ID 8318969 https://ift.tt/2nkqRvX

Why Day Trader Marcello Arrambide Is Bringing Business Opportunities to Developing Nations - Thehour.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2niTt8U

Chucking rubbish in ocean is too cheap: PM - Newcastle Herald

from RSSMix.com Mix ID 8318969 https://ift.tt/2mHeNER

Proven ways you can make money in real estate - Daily Monitor

from RSSMix.com Mix ID 8318969 https://ift.tt/2mDtXLq

Wednesday, September 25, 2019

How To Build An Authority Blog

from RSSMix.com Mix ID 8318969 https://ift.tt/2leo7zL

Hottest toys for the holidays make your kids work for their love - The Detroit News

from RSSMix.com Mix ID 8318969 https://ift.tt/2mT3Foj

Labradoodle Creator Dogged By Personal Regrets - HuffPost

from RSSMix.com Mix ID 8318969 https://ift.tt/2mIPD8O

Tesla, Electric Vehicles, and the Profitability Conundrum - Market Realist

from RSSMix.com Mix ID 8318969 https://ift.tt/2n3FGmv

As a gangster in Toronto, I was drawn to the lure of the gun. I know what it takes to stop it - The Globe and Mail

from RSSMix.com Mix ID 8318969 https://ift.tt/2latbF9

Fintech Unfiltered: Digit's Bloch on the future of personal finance - bankinnovation.net

from RSSMix.com Mix ID 8318969 https://ift.tt/2l8EQnX

Why Some Debts Just Shouldn't Be Paid Back Early - The Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2lIOgGW

3 Stocks to Buy Ahead of the Next Market Crash - Motley Fool

from RSSMix.com Mix ID 8318969 https://ift.tt/2lEPCCA

Giuliani: Democrats Have 'Stepped Into Something Way Beyond What They Realize' - CNSNews.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2lF01y8

The 25 Best Charlie Moments on It’s Always Sunny in Philadelphia - Vulture

from RSSMix.com Mix ID 8318969 https://ift.tt/2lC7U7L

Generation Side Hustle Is Changing The Face Of Marketing - Forbes

from RSSMix.com Mix ID 8318969 https://ift.tt/2ndqO56

Military Contractors and the Hidden Flow of Bipartisan Blood Money - ghionjournal.com

from RSSMix.com Mix ID 8318969 https://ift.tt/2ngz0BD

Chucking rubbish in ocean is too cheap: PM - Newcastle Herald

from RSSMix.com Mix ID 8318969 https://ift.tt/2mHeNER

Mario Kart Tour price: 'free-to-start' explained, and how the new Nintendo mobile game makes money - iNews

from RSSMix.com Mix ID 8318969 https://ift.tt/2kSmsjj

Subway haunted by franchise model that forces locations to close - Business Insider

from RSSMix.com Mix ID 8318969 https://ift.tt/2lxjn8E

Sen. Marco Rubio: For lawmakers, GM-UAW strike a lesson in national strength, industry - USA TODAY

from RSSMix.com Mix ID 8318969 https://ift.tt/2lRTIaL

Jenelle Evans Says She Might Return To 'Teen Mom' - The Blast

"Teen Mom 2" former member Jenelle Evans has hinted that she might make a return to the MTV show, though there is no confirmation of anything right now.

from RSSMix.com Mix ID 8318969 https://ift.tt/2kS55ij

This could be 'dry powder' for the markets, money manager says - CNBC

Stocks are in search of their next catalyst. There's a trillion-dollar market mover in the making, says Bill Stone, chief investment officer at Avalon Investment.

from RSSMix.com Mix ID 8318969 https://ift.tt/2kSUdRt

Pepperfry, Indian furniture e-commerce firm, eyes profits, IPO - Quartz India

Office parties are mostly about winding down. But at eBay India's New Year party in 2010, two of the company's top employees got talking business. “Ambareesh ...

from RSSMix.com Mix ID 8318969 https://ift.tt/2lzzYs6

MCAO: Deputy County Attorney Juan Martinez reassigned - FOX 10 News Phoenix

Officials with the Maricopa County Attorney's Office announced they have reassigned Deputy County Attorney Juan Martinez.

from RSSMix.com Mix ID 8318969 https://ift.tt/2lzg3cR

Humans of UTSA : Justice Falade - UTSA The Paisano

This is Justice Falade. He is a senior and an electrical engineering major. He only wants the best for his future, and his ambitious spirit is helping him get there.

from RSSMix.com Mix ID 8318969 https://ift.tt/2mySbXb

Kokomo business step up to support striking GM workers - WRTV Indianapolis

KOKOMO — The United Auto Workers strike against General Motors is about to hit day 10 on Wednesday. That's 10 days of GM workers not receiving full pay, ...

from RSSMix.com Mix ID 8318969 https://ift.tt/2mWlm6u

How To Make Money Doing Nothing - Lifehacker Australia

Unless you're an Instagram influencer, you probably have to exert some kind of physical or mental effort to make money. For those of us in the corporate slog, ...

from RSSMix.com Mix ID 8318969 https://ift.tt/2mYa2GZ

3 Stocks That Got Crushed by the Market on Tuesday - Motley Fool

BlackBerry recorded a steep decline based on quarterly results, while Uber and Lyft notably decelerated.

from RSSMix.com Mix ID 8318969 https://ift.tt/2lxDVxt